-

-

This Terms and Conditions

Agreement (“Terms”) is entered into by and between Tally Account Aggregator Services

Private Limited (“us”/“we”/“our”), a company registered under laws of India

and the Customer (“you”, “your”), for the Services (defined below). Your

use of

our website and application (collectively “Platform”) is governed by these Terms. These Terms

constitute a binding and enforceable legal contract between you and us.

-

By using the Services or the

Platform, you acknowledge to have read, understood, and agree to be legally bound by these

Terms, and that you shall

comply with the requirements listed hereunder. If you do not agree to all of these Terms or

comply

with the requirements listed herein, please do not access the Platform or use the Services. We

reserve the right to modify or terminate any portion of the Platform or the Services offered by

us or amend the Terms for any reason, without notice and without liability to you or any third

party. To make sure you are aware of any changes, please review the Terms periodically.

-

These Terms shall be read in conjunction with our privacy policy,

available at www.tallyedge.com

(“”), and any

guidelines, additional terms,

policies, or disclaimers made available or issued by us from time to time.

-

Capitalised terms used in

these Terms shall have the same meaning as ascribed to them in the AA Master Directions

(defined below) unless the context indicates otherwise.

-

-

“AA Master Directions”

shall mean the Master Direction - Non-Banking Financial Company -Account Aggregator (Reserve

Bank) Directions, 2016 as amended, revised, or updated from time to time; and

-

“Applicable Law” shall

mean any statute, law, regulation, ordinance, rule, judgment, notification, order, decree,

by-law, permits, licenses, approvals, consents, authorisations, government approvals,

directives, guidelines, requirements or other governmental restrictions, or any similar form of

decision of, or determination by, or any interpretation, policy or administration, having the

force of law of any of the foregoing, by any regulatory authority.

-

“Financial Information” shall have the same meaning ascribed to it in the AA Master

Directions;

-

“Financial Information

Provider” shall have the same meaning ascribed to it in the AA Master Directions;

-

“Financial Information

User” shall have the same meaning ascribed to it in the AA Master Directions;

-

“Financial Sector

Regulator” shall have the same meaning ascribed to it in the AA Master

Directions;

-

“RBI”

shall mean the Reserve Bank of India.

-

Tally Account Aggregator Services Private Limited or Tally Edge

includes

affiliates, subsidiaries, group and associate companies of Tally Account Aggregator Services

Private Limited.

-

-

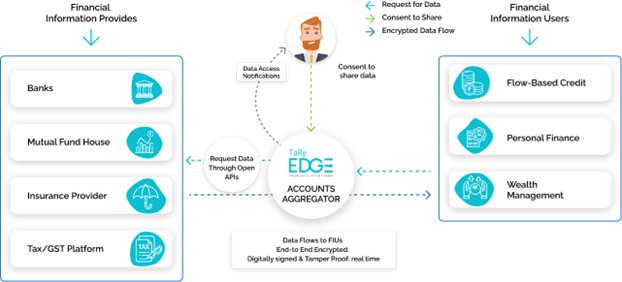

Through the Platform, you may

retrieve, view, consolidate and share Financial Information that is available with Financial

Information Providers, and present your Financial Information to Financial Information Users.

-

The services offered by us

through the Platform are referred to as “Services” (which term also includes the provision of

the Platform to you).

-

For us to render the Services

to you, you hereby authorise and appoint us as your agent with limited power to access, fetch or

retrieve, with your consent, your Financial Information, sensitive personal information, etc.,

from Financial Information Providers.

-

The provision of any or all

the Services is subject to Applicable Laws in India. Further, the provision of any or all of the

Services is subject to our sole discretion and their availability on the Platform.

-

Pursuant to

our Privacy Policy, you may revoke your consent at any point of time.

-

Use of the Platform is available only to

those individuals and organizations who can form legally binding contracts under Applicable Law in their

respective jurisdictions. If you are a minor, i.e., under the age of 18 years, you shall not register as

a user of the Platform and shall not use the Platform. As a minor, if you wish to use the Platform, such

use may be made by your legal guardian or parents on the Platform. We reserve

the right to terminate

your membership and/or refuse to provide you with access to the Platform if it is brought to our notice

or if it is discovered that you are under the age of 18 years. You represent and warrant that you have

full legal capacity and authority to agree and bind yourself to these Terms. If you are authorized to

act on behalf of an entity, organisation, or any other legal person, you confirm and represent that you

have the necessary power and authority to bind such entity, organisation, or legal person to these Terms

and your acceptance of these Terms implies acceptance by such relevant organization/institution.

-

-

To avail the Services, you

will be required to create a profile on the Platform (“Profile”). In addition to setting up a

username and password to create the Profile, you will be required to furnish certain details,

including but not limited to phone numbers and other personal information. You warrant that all

information furnished in connection with your Profile is and shall remain accurate and true, and

you agree that you shall promptly update your details on the Platform in the event of any change

to or modification of this information.

-

You will maintain the security

and confidentiality of your username and password and immediately notify us of any disclosure or

unauthorised use of your Profile or any other breach of security with respect to your Profile.

-

You will be liable and

accountable for all activities that take place through your Profile. We shall in no manner be

liable for any unauthorised access to your Profile.

-

We do not independently verify

the information provided by you and therefore, we shall in no way be responsible or liable for

the accuracy, inaccuracy, obsolescence, or completeness of any information provided by you.

-

If you provide any information

(or if we have reasonable grounds to suspect that you have provided information) that is untrue,

inaccurate, obsolete, or incomplete, we may suspend or terminate your Profile and refuse any use

of the Services.

-

You will maintain the

confidentiality of your password. We will not be liable for any leak of information on your part

and the consequences of the same. You agree to immediately notify us of any disclosure or

unauthorized use of your credentials or any other breach of security concerning your Profile.

-

By providing us with your

email address and mobile number, you agree to receive all required notices, notifications, and

information electronically on that email address or mobile number. It is your responsibility to

update any changes to your email address and mobile number.

-

The Company will not retrieve, share, or

transfer your Financial Information without your explicit consent. The Company shall perform the

function of obtaining, submitting, and managing your consent in accordance with the AA Master

Directions.

The Company shall obtain your consent in

a standardized consent artefact which shall contain the following details:

-

Your identity and contact

information; and

-

The nature of

the Financial Information requested; and

-

purpose of

collecting such Financial Information; and

-

the identity of the recipients of

the Financial Information, if any; and

-

URL or other address to which

notification needs to be sent every time the consent artefact is used to access information; and

-

Consent

creation date, expiry date, identity, and signature/ digital signature of the Company; and

-

any other attribute as may be

prescribed by the RBI.

At the time of obtaining consent, the

Company shall inform you of all necessary attributes to be contained in the consent artefact as

mentioned above and your right to file complaints with relevant authorities in case of non-redressal of

grievances.

-

In this respect, we will comply with all

Applicable Laws, in particular the AA Master Directions, and do everything that is required of us by the

AA

Master Directions, while providing the Services to you.

-

We shall

provide the Services to you on the basis of your explicit consent.

-

-

-

We shall ensure

that no information is shared without your explicit consent.

-

-

-

-

-

-

use the Services to

transmit any data or send or upload any material that contains viruses, trojan horses,

worms, timebombs, keystroke loggers, spyware, adware, or any other harmful programmes or

similar computer code designed to adversely affect the operation of any computer

software or hardware; and/or

-

use any robot, spider,

other automated device, or manual process to monitor or copy the Platform or any portion

thereof and/or;

-

engage in the

systematic retrieval of content from the Platform to create or compile, directly or

indirectly, a collection, compilation, database, or directory; and/or

-

use the Services in

(A) any unlawful manner, (B) for fraudulent or malicious activities, or (C) in any

manner inconsistent with these Terms; and/or

-

violate Applicable Laws in any manner.

-

You warrant that you shall not

engage in any activity that interferes with or disrupts access to the Platform.

-

You shall not attempt to gain

unauthorised access to any portion or feature of the Platform, any other systems or networks

connected to the Platform, to any of our servers, or through the Platform, by hacking, password

mining, or any other illegitimate means.

-

FIU shall never request your

credentials (like passwords, PINs, private keys) which may be used for authenticating your

Account at FIP and that you should never provide these details.

-

-

-

All rights, title, and

interest in and to the Platform and Services, including all intellectual property rights arising

out of the Platform and Services, are owned by, or otherwise licensed to us. You agree not to

display or use, in any manner, our intellectual property rights including trademarks without our

prior written permission.

-

Except as stated herein, none

of the materials may be modified, copied, reproduced, distributed, republished, downloaded,

displayed, sold, compiled, posted, or transmitted in any form or by any means, including but not

limited to, electronic, mechanical, photocopying, recording or other means, without our prior

express written permission. Save and except with our prior written consent, you may not insert a

hyperlink to the Platform, or modify/ alter any information or materials contained in the

Platform.

-

No license or other such right

is granted per this Agreement and your access to and/or use of the Platform should not be

construed as granting, by implication, estoppel or otherwise, any license or right to use any

trademarks, service marks or logos appearing in the Platform without the prior written consent

of the Company or the relevant third party proprietor thereof.

-

-

These Terms shall remain in

effect unless terminated in accordance with the terms hereunder.

-

We may terminate your access

to or use of the Services, or any portion thereof, immediately and at any point, at our sole

discretion if you violate or breach any of the obligations, responsibilities, or covenants under

these Terms, or when you cease to become a user of our Services or Platform.

-

Upon

termination of these Terms:

-

the

Profile will expire; and/or

-

the

Services will “time-out”; and/or

-

these Terms shall

terminate, except for those clauses that expressly or are intended to survive

termination or expiry.

-

-

We do not warrant the

accuracy, suitability, or correctness of any Financial Information that is made available on or

through the Services. The Platform and the Services are provided by us on an “as is” basis

without warranty of any kind, (whether express, implied, statutory, or otherwise),

including the implied

warranties of title, non-infringement, merchantability, or fitness for a particular purpose.

Without limiting the foregoing, we make no warranty that:

-

the Platform or the

Services will meet your requirements or expectations, or that your use of the Services

will be uninterrupted, timely, secure, or error-free; and

-

any

errors or defects in the Platform will be corrected.

-

No advice or information,

whether oral or written, obtained by you from us shall create any warranty that is not expressly

stated in these Terms.

-

To the fullest extent

permissible under Applicable Law, we, our affiliates, and related parties each disclaim all

liability towards you for any loss or damage arising out of or due to:

-

your

use of, inability to use, or availability or unavailability of the Services;

-

the occurrence or

existence of any defect, interruption, or delays in the operation or transmission of

information to, from, or through the Services, communications failure, theft,

destruction or unauthorized access to our records, programmes, services, server, or

other infrastructure relating to the Services; or the failure of the Services to remain

operational for any period of time.

-

Further, all Financial

Information obtained from Financial Information Providers may be based on delayed feeds and may

not reflect the real-time/ rates. We shall not be responsible for any errors or delays in the

Financial Information provided to the Financial Information Users as part of its Services or for

any actions taken by the Financial Information Users in reliance thereon.

-

The use of any information set

out is entirely at your own risk. You should exercise due care and caution (including if

necessary, obtaining of advise of tax/ legal/ accounting/ financial/ other professionals) prior

to acting or omitting to act, on the basis of the information contained / data generated herein.

We shall not be liable for any loss arising from the use of the Services and/or the Platform.

You will be solely liable for any consequences, legal, financial or other, that may arise out of

usage of the Services.

-

We do not warrant that access

to the Platform shall be uninterrupted, timely, secure, or error free nor does it make any

warranty as to the results that may be obtained from the Platform or use, accuracy or

reliability of Services.

-

We reserve the right to modify these

Terms, in our sole discretion, at any time. Such modifications may be posted through the Services, on

our Platform or when we notify you by other means. The changes may be periodically intimated to you and

your continued use of the Services indicates your agreement to the modifications.

-

-

This Agreement shall be

governed by and construed in accordance with the laws of India.These Terms, the Services and

the relationship between you and us shall be governed in accordance with the laws of India. You

agree that all claims, differences, and disputes arising under or in connection with or in

relation

hereto the

Platform, these Terms, the agreement(s) entered into on or through the Platform or the

relationship between you and us shall be subject to the exclusive jurisdiction of the courts at

Bangalore.

-

Subject to the foregoing, in

the event of a dispute whatsoever arising in any way connected with the interpretation or

implementation of any term of these Terms, or in any way connected with the use or inability to

use the Services, the same shall be referred to an arbitrator appointed in

accordance with the Arbitration and Conciliation Act, 1996 as amended from time to time, and the

decision of the arbitrator will be final and binding. The arbitration proceedings will be held

in Bangalore, India.

-

In no event shall we be liable for any

special, incidental, punitive, indirect or consequential damages whatsoever (including but not limited

to damages for loss of profits, loss of confidential or other information, for business interruption,

for personal injury, for loss of privacy, for failure to meet any duty including of good faith or of

reasonable care, negligence, and any other pecuniary or other loss whatever) arising out of or in any

way related to the use of or inability to use the Services or failure to provide support or other

services, information and related content through the software or Platform, or otherwise arising out of

the use of the Services, even if you have been advised of the possibility of such damages. In no event

will our entire liability to you in respect of Service and Platform, whether direct or indirect, exceed

the payment made to us by you. We shall have no liability to you if we are prevented from or delayed in

performing our obligations due to force majeure event.

-

These Terms represents the complete and

exclusive understanding between you and us regarding your use of Services. If any provision of these

Terms is found to be void, invalid, or unenforceable, it shall be severed from and shall not affect the

remainder of these Terms, which shall remain valid and enforceable.

-

No third party shall have any rights to

enforce any terms contained herein.

-

Grievance Redressal Policy is formulated

with a purpose to provide the efficient

customer service support through a laid down procedure and the same can be accessed via link

“Grievance

Redressal Policy”

on company’s website. In terms of the Master Directions of RBI, if the

complaint/grievance is not resolved within a period of one month from reporting, you may appeal to

the Reserve Bank of India (RBI).

-

We will go beyond efficiency and fairness by providing all our services at prices that enable our partners to provide affordable services to their users. The structuring of the prices will be carefully and consultatively tailored to each market segment. The users shall benefit from the usage of the product at no direct cost of downloading, registering and using the services to share data with FIUs. The user can be charged for data that they download for their own purposes using Tally Edge application. For further information, the Pricing Policy can be accessed via link

“” on the Company’s website.

-

We shall have no liability to you if we are

prevented from or delayed in performing our obligations or from carrying on our business by acts, events,

omissions, or accidents beyond our reasonable control, including, without limitation, strikes, failure of a

utility service or telecommunications network, the act of God, war, riot, civil commotion, pandemic

situations,

malicious damage, compliance with any law or governmental order, rule, regulation, or direction.

-

You agree not to disclose or attempt to use or personally benefit from any non-public

information that you may learn or discover on the Platform or through the Services. This obligation shall

continue until such time as the non-public information has become publicly known through any action of

yours. If you are compelled by order of a court or other governmental or legal body (or have notice that

such an order is being sought) to divulge any such non-public information, you agree to notify us promptly

and diligently and cooperate fully in protecting such information to the extent possible under applicable

law.

We may access, preserve and disclose any of your information, if required, subject to applicable law, for

the facilitation of any Services to you as per your explicit request, or to do so to ensure compliance with

applicable law, or if we believe in good faith that it is reasonably necessary to (i) respond to claims

asserted against us or to comply with legal process, (ii) for fraud prevention, risk investigation, your

support, product development and de-bugging purposes, or (iii) protect our rights, property or safety of our

users or members of the public.

-

Any access to a third party’s software applications or links on the Platform shall be

at

your sole risk, and we shall not be liable for any losses sustained by you, or any third party in this

regard. You understand and agree that when you access a link that leaves our Platform or any third-party

software applications on the Platform, the site you will enter into or the third-party software you

access,

and use is not controlled by us and will have different terms of use and privacy policies that may be

applicable. By accessing links to other sites or accessing such third-party software applications, you

acknowledge that we are not responsible for those sites/third party software. Your use of any

third-party

software application or links on the Platform is subject to the license you agreed to with the third

party

that provides you with the software/links. We do not own or control nor do we have any responsibility or

liability for any third-party software application or links that you elect to use on our Platform and/or

in

connection with the Services. Any transaction you undertake on such third party sites or third party

software applications would be solely at your own risk, and we shall not be liable for it in any way. We

reserve the right to disable third party links or software applications on the Platform, although we are

under no obligation to do so.